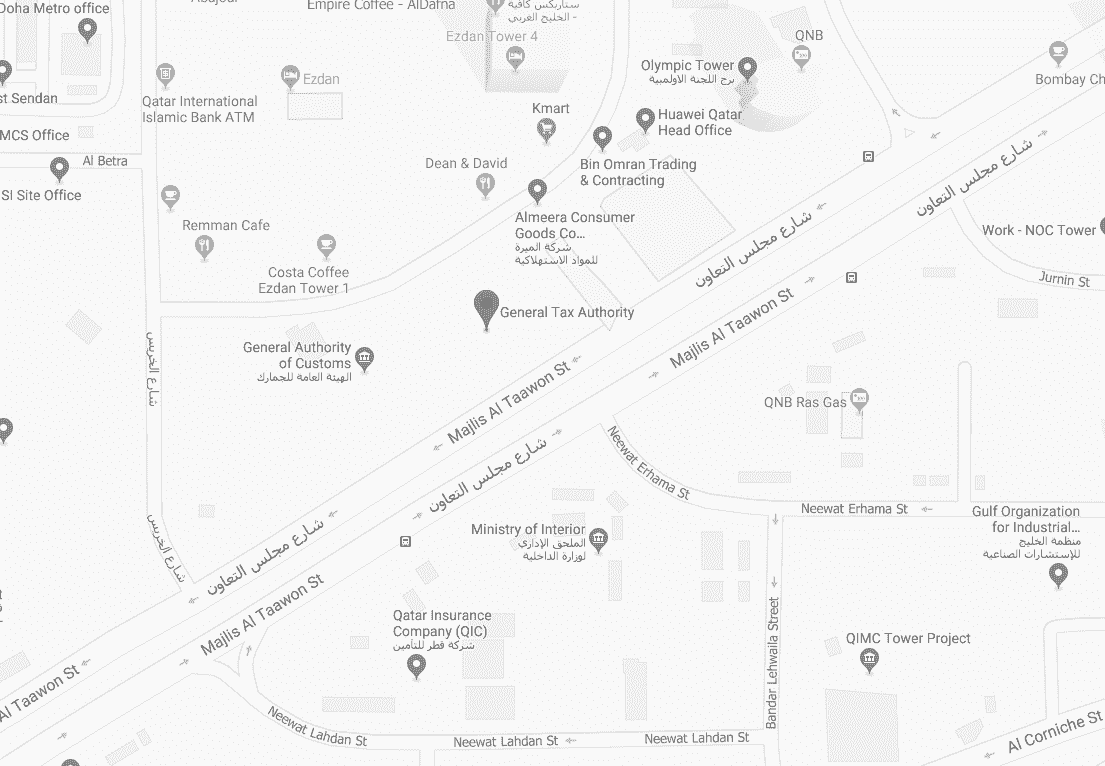

General Tax Authority

The General Tax Authority Provides Support to Taxpayers Regarding the Financial Penalty Exemption Initiative and Other Tax Services

The General Tax Authority continues its ongoing efforts to facilitate taxpayers’ procedures and ensure the regularity of their tax transactions. As part of these efforts, taxpayers are now able to submit applications for the Financial Penalty Exemption Initiative at 100% directly at the Authority’s Tower, in addition to receiving support for a range of other tax obligations and services.

The services provided during this period include submitting exemption applications, filing objections and settlements, as well as services related to collection, inquiries, sales, and clearances, in addition to technical support for resolving any issues that taxpayers may encounter in the system.

Taxpayers can visit the Authority’s Tower on Mondays and Wednesdays from 8:00 AM to 12:00 PM until 31 December 2025, where dedicated teams are available to provide support and assistance, ensuring that transactions are completed easily and efficiently. Taxpayers can also apply electronically via the “Dhareeba” platform to benefit from the initiative.

The Authority confirms that the 100% Financial Penalty Exemption Initiative will continue until 31 December 2025, reaffirming its commitment to promoting tax compliance and building a strong and sustainable partnership and trust with all taxpayers.

Top news

-

The General Tax Authority Announces the Implementation of the Global and Domestic Minimum Tax in Line with the Latest International Standards

12-Feb-2026 -

Finance, Tax, and Customs Authorities Celebrate National Sports Day at Old Doha Port

10-Feb-2026 -

State of Qatar Participates in the Sixth Meeting of the Global Forum on VAT in Paris

28-Jan-2026 -

The General Tax Authority Organizes a Padel Tournament to Strengthen Partnerships and Promote a Positive Work Environment

27-Jan-2026 -

General Tax Authority Seizes Goods Non-Compliant with Laws Governing the Circulation of Tobacco Products and Their Derivatives

5-Jan-2026

Thank you for subscribing to the newsletter