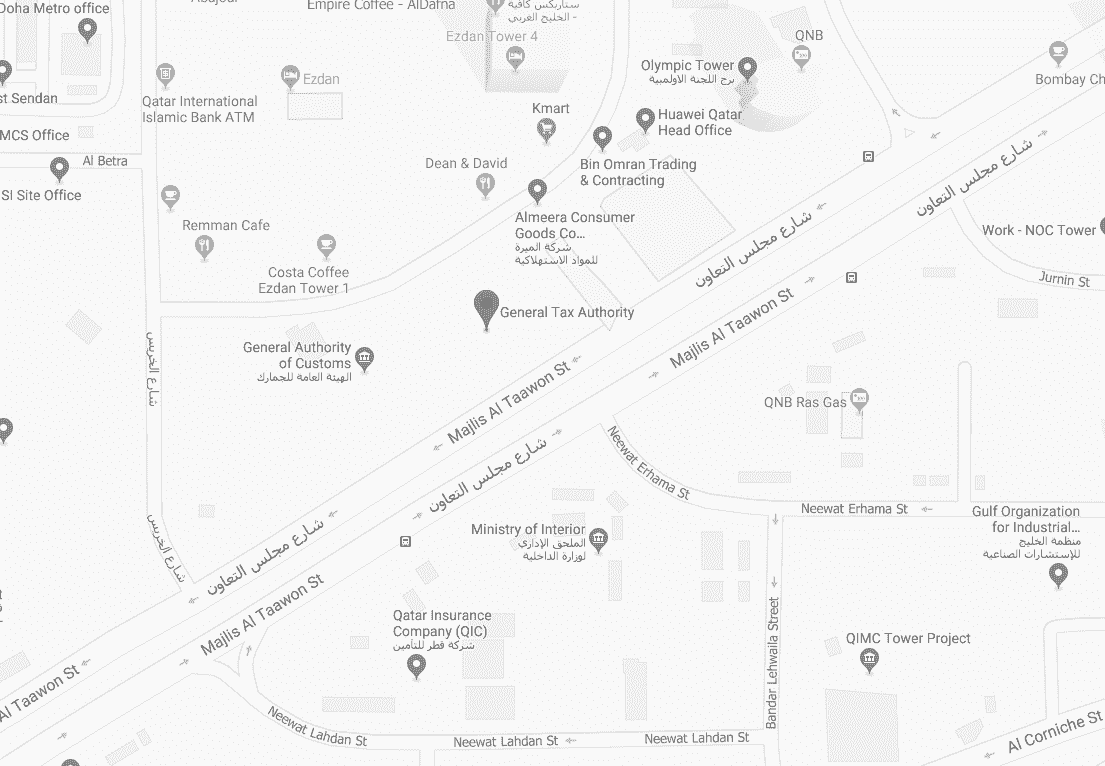

General Tax Authority

Automated Information Exchange

The Common Reporting Standard (CRS) is a global standard for the automatic exchange of financial account information. It was developed by the Organization for Economic Cooperation and Development (OECD).

designed to prevent offshore tax evasion. It gives participating countries transparency on the financial assets held offshore by their residents.

CRS requires financial institutions to identify customer tax residencies and report financial accounts held directly or indirectly by foreign tax residents to local tax authorities. It also requires tax authorities (in participating countries) to exchange this information.

Country-by-Country Reporting (CbCR) is part of the OECD’s Base Erosion and Profit Shifting (BEPS). In essence, large multinationals must provide an annual return, the CbC report, that breaks down key elements of the financial statements by jurisdiction. A CbC report provides local tax authorities visibility to revenue, income, tax paid and accrued, employment, capital, retained earnings, tangible assets and activities.

The Foreign Account Tax Compliance Act (FATCA), which was passed as part of the HIRE Act, generally requires that foreign financial Institutions and certain other non-financial foreign entities report on the foreign assets held by their U.S. account holders or be subject to withholding on withholdable payments. The HIRE Act also contained legislation requiring U.S. persons to report, depending on the value, their foreign financial accounts, and foreign assets.

https://tabadol.gta.gov.qa/

Download Dhareeba app on your smart device now

Download Dhareeba app on your smart device now Call Center

Call Center Overseas

Overseas

Subscribe to the newsletter

All rights reserved © 2026 to the General Tax Authority - State of Qatar

Top of the Page

Top of the Page

Top of the Page

Top of the Page

Thank you for subscribing to the newsletter