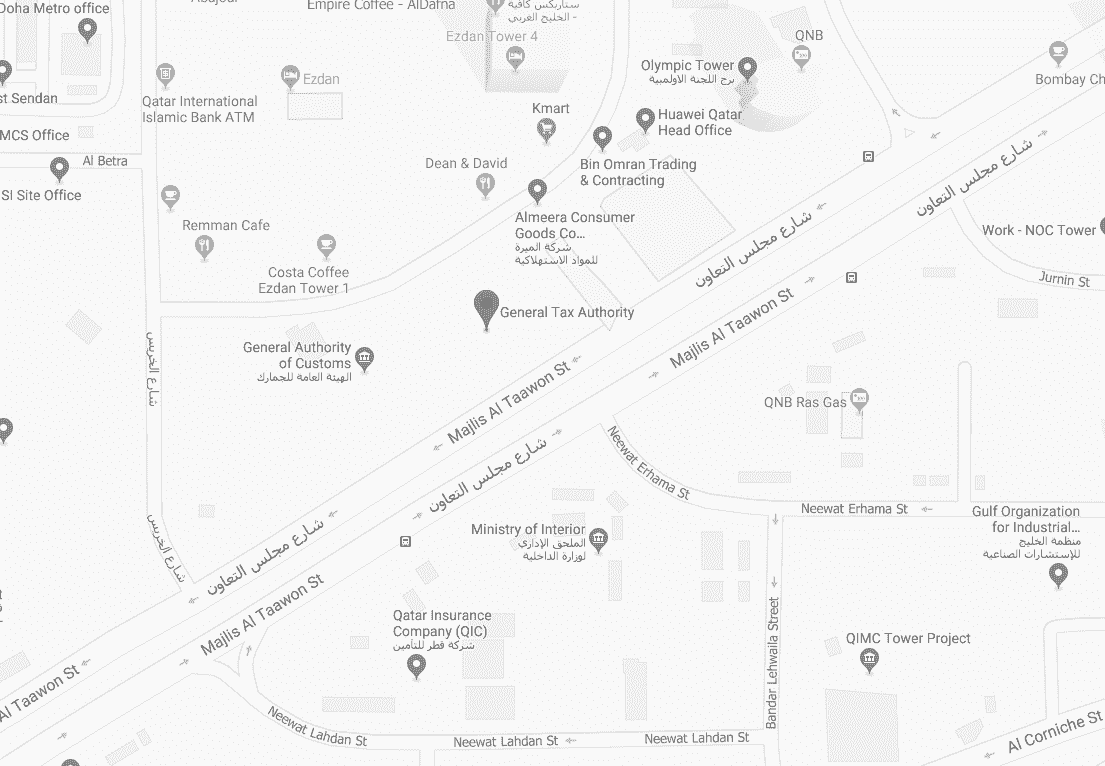

General Tax Authority

The General Tax Authority Announces the Tax Return Filing Dates for the Tax Year Ending December 31, 2024

The General Tax Authority (GTA) has announced that the tax filing period for the fiscal year ended December 31, 2024, will commence on January 1, 2025, and conclude on April 30, 2025.

This requirement is implemented in accordance with the Income Tax Law (Law No. 24 of 2018), its Executive Regulations, and subsequent amendments. Under these provisions, all entities subject to the Law - including tax exempt companies and those fully owned by Qatari or other GCC nationals, as well as those with non-Qatari partners - must file their tax returns within the specified period.

The GTA called on all companies and enterprises holding a commercial registration or license to submit their returns through the Dhareeba Tax Portal.

In this regard, the GTA remains committed to delivering integrated services designed to simplify the tax return filing process and ensure that taxpayers receive the necessary guidance and support to meet their obligations timely. The GTA will also continue to offer comprehensive assistance to taxpayers - both through its call center (16565) and the dedicated support email (support@dhareeba.qa).

This aligns with the GTA’s commitment to streamline tax procedures, enhance compliance, support Qatar’s fiscal policy objectives, and promote sustainable economic growth.

Top news

-

The General Tax Authority Announces the Implementation of the Global and Domestic Minimum Tax in Line with the Latest International Standards

12-Feb-2026 -

Finance, Tax, and Customs Authorities Celebrate National Sports Day at Old Doha Port

10-Feb-2026 -

State of Qatar Participates in the Sixth Meeting of the Global Forum on VAT in Paris

28-Jan-2026 -

The General Tax Authority Organizes a Padel Tournament to Strengthen Partnerships and Promote a Positive Work Environment

27-Jan-2026 -

General Tax Authority Seizes Goods Non-Compliant with Laws Governing the Circulation of Tobacco Products and Their Derivatives

5-Jan-2026

Thank you for subscribing to the newsletter