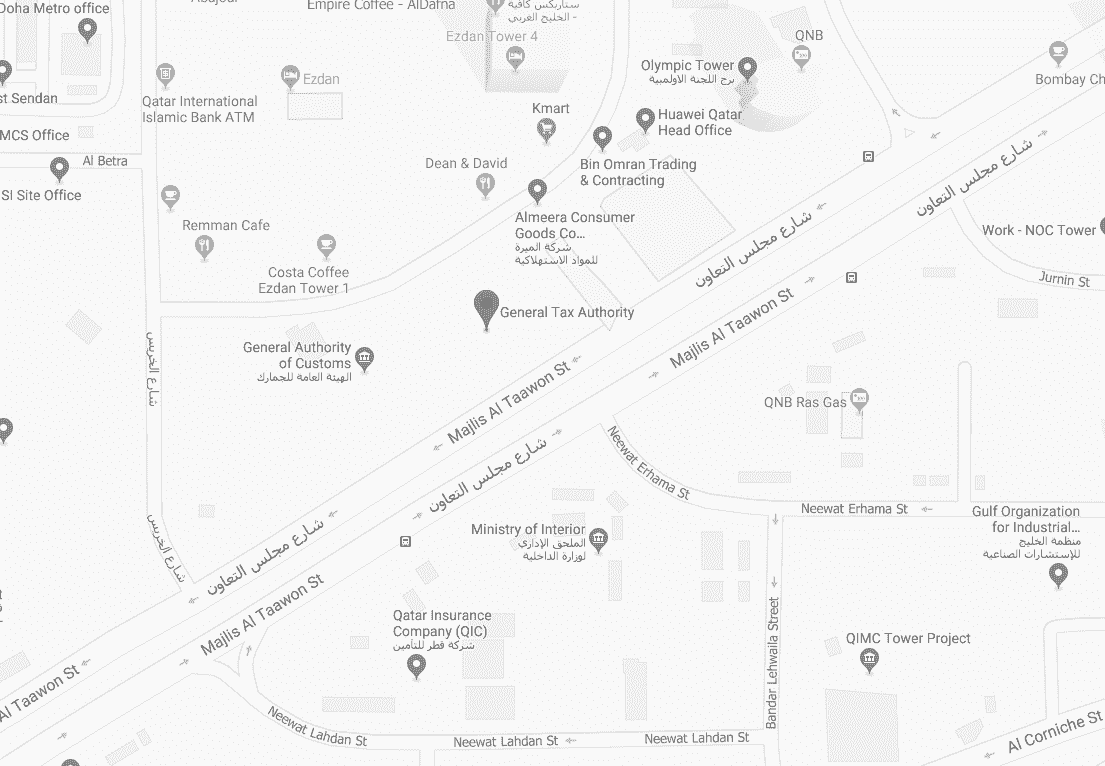

General Tax Authority

The General Tax Authority Announces an Extension of Validity for Several Certificates to Facilitate Taxpayer Procedures

The General Tax Authority (GTA) has announced the extension of validity for several tax certificates required by taxpayers to complete their transactions. This comes as part of its commitment to support them and to simplify procedures related to their tax obligations.

Among the updates is the extension of the validity period for the Non-Objection Certificate (NOC) for Change of Ownership, which is now valid for 180 days, giving taxpayers additional time to complete their transactions.

In the same context, GTA now allows the issuance of the Tax Compliance Certificate via the Dhareeba Tax Portal. The validity of this certificate has been extended from one month to one full year. This certificate serves as an official document proving the taxpayer’s compliance with all tax obligations, facilitating smoother dealings with various entities and enhancing investment opportunities.

Additionally, the validity period of the NOC for Commercial Registration Cancellation or issuing the Disbursement of Dues Certificate has been extended to 90 days, providing taxpayers with additional time to complete necessary procedures without the need to resubmit requests.

The Authority emphasized that this step is part of its commitment to improving services and enhancing the user experience. It noted that the certificates are available for issuance through the “Dhareeba” platform, along with a range of other electronic services that offer taxpayers a more flexible and efficient experience in managing their tax obligations.

Top news

-

The General Tax Authority Announces the Implementation of the Global and Domestic Minimum Tax in Line with the Latest International Standards

12-Feb-2026 -

Finance, Tax, and Customs Authorities Celebrate National Sports Day at Old Doha Port

10-Feb-2026 -

State of Qatar Participates in the Sixth Meeting of the Global Forum on VAT in Paris

28-Jan-2026 -

The General Tax Authority Organizes a Padel Tournament to Strengthen Partnerships and Promote a Positive Work Environment

27-Jan-2026 -

General Tax Authority Seizes Goods Non-Compliant with Laws Governing the Circulation of Tobacco Products and Their Derivatives

5-Jan-2026

Thank you for subscribing to the newsletter