Media Center

Media Center

As part of its ongoing efforts to align the national tax system with international best practices, the General Tax Authority announces the commencement of the implementation of Chapter Seven (Repealed and Re-enacted) of the Income Tax Law issued under Law No. (24) of 2018 and its amendments, which sets out the rules for applying the global and domestic minimum tax, thereby enhancing the principles of transparency and fairness in the tax system. This decision comes within the context of implementing Pillar Two of the global initiative led by the Organization for Economic Co-operation and Development (OECD) and the Group of Twenty (G20) to address the tax challenges arising from the digitalization of the economy, known as the Global Minimum Tax Agreement. This initiative aims to impose an effective minimum tax rate of 15% on the profits of multinational enterprises with foreign operations, provided that their revenues exceed EUR 750 million. It also represents the implementation of the latest amendment to the Income Tax Law and introduces two fundamental rules in modern tax policy: the Global Minimum Tax (Qualified Income Inclusion Rule) and the Domestic Minimum Tax (Qualified Domestic Minimum Top-up Tax). This step reflects the State of Qatar’s efforts to keep pace with international initiatives to ensure that multinational companies contribute their fair share of taxes worldwide. This decision also underscores the State’s leading role in strengthening the Inclusive Framework of the OECD and the G20 on Base Erosion and Profit Shifting (BEPS), as well as in protecting the national tax base from the unlawful shifting of profits to low-tax jurisdictions or the loss of national tax revenues to other countries. In this regard, the General Tax Authority affirmed that this approach reflects the State of Qatar’s commitment to complying with international best practices in the tax field and enhances its position as a reliable and transparent economic and financial hub on the global stage. The GTA will issue the necessary guidance manuals and executive decisions in the coming phase to clarify the implementation mechanisms, in accordance with the standards set under Pillar Two, including the Global Minimum Tax (GloBE) rules. It is noteworthy that this decision represents a strategic step in supporting the balance between attracting foreign direct investment, safeguarding tax sovereignty, and upholding financial fairness within the country.

On the occasion of National Sports Day, the Ministry of Finance, the General Tax Authority and the General Authority of Customs, organized a joint sports event at Old Doha Port. The initiative reflects the participation of government institutions in this national event, which aims to promote a culture of physical activity and encourage healthy lifestyles. The event was attended by H.E. Mr. Ali bin Ahmed Al-Kuwari, Minister of Finance; H.E. Mr. Khalifa bin Jassim Al-Jaham Al-Kuwari, President of the General Tax Authority and leaders from the General Authority of Customs, alongside a number of employees from the three authorities. Their presence underscores the importance of institutional participation in supporting national initiatives with health and community-oriented objectives. The program included a variety of sports activities, such as walking, fitness exercises, and competitive games, which allowed for broad participation and fostered interaction and communication among attendees, transforming the occasion from a symbolic celebration into active engagement in physical activity. The event’s significance lies in its contribution to a broader national approach linking health and quality of life. It highlights the role of government institutions in actively raising awareness about the importance of sports, particularly in light of modern lifestyle challenges characterized by reduced physical activity. National Sports Day is an annual occasion to renew community commitment to sports, promote positive health behaviors, and encourage individuals to adopt regular physical activity as a sustainable lifestyle, in line with the country’s vision of building a healthy, productive, and balanced society. This event was organized in implementation of the Amiri Decree issued in 2011, which designates the second Tuesday of February each year as National Sports Day, aiming to encourage sports participation and promote a healthy lifestyle.

His Excellency Mr. Khalifa bin Jassim Al-Jaham Al-Kuwari, President of the General Tax Authority, headed the delegation of the State of Qatar participating in the Sixth Meeting of the Global Forum on Value Added Tax (VAT) in Paris. The forum was organized by the Organization for Economic Co-operation and Development (OECD) and held in Paris from 26 to 28 January 2026. The forum is considered a high-level international platform that brings together senior officials from tax administrations around the world to discuss the design and implementation of VAT/GST systems, exchange experiences in addressing challenges related to the digital economy, e-commerce, crypto-assets, and artificial intelligence, as well as to review best practices aimed at enhancing tax compliance and developing risk management mechanisms. The State of Qatar’s participation in this meeting reaffirms its commitment to strengthening international cooperation in the field of tax policy and exchanging expertise in a manner that contributes to enhancing the efficiency of domestic tax systems, in addition to supporting international efforts to modernize and develop tax frameworks in line with evolving economic and technological changes.

The General Tax Authority held the padel tournament with the participation of a number of its employees, along with employees from financial audit firms, on 19 and 20 January 2026. This initiative reflects the Authority’s commitment to enhancing institutional communication and fostering a culture of sports and physical activity in the workplace. The tournament was marked by a positive competitive atmosphere that reflected cooperation and interaction among participants, contributing to stronger professional relationships and the building of effective partnerships in a friendly setting, while supporting the values of collaboration and institutional integration. The winning team was honored in recognition of its outstanding performance and the high competitive standard it demonstrated. This initiative forms part of the General Tax Authority’s efforts to support a motivating work environment and promote positive practices that enhance performance efficiency and reinforce a culture of communication and partnership among employees.

As part of its ongoing efforts to enhance tax compliance, the General Tax Authority announced the seizure of a number of retail outlets found in violation of the Excise Tax Law, as part of its regulatory campaigns aimed at combating the illicit circulation of tobacco products. The Authority’s inspection team, succeeded in seizing and confiscating more than 5,000 packs of tobacco products that were not bearing approved tax stamps and did not meet the approved specifications. Legal reports were issued against the owners of the violating outlets, in preparation for taking and completing the necessary legal actions in accordance with the applicable legislation. These measures come as part of the Authority’s ongoing inspection campaigns, which include the analysis and auditing of supply chains to detect and combat the illicit trade of tobacco products, and the application of compliance standards set out in the World Health Organization Framework Convention on Tobacco Control, thereby contributing to the reduction of health risks associated with the circulation of smuggled products, which pose greater risks to consumer health. The Authority’s efforts in this regard are aligned with the Third National Development Strategy (2024–2030), which aims to ensure a high quality of life for individuals by reducing the prevalence of smoking. They are also consistent with the National Health Strategy, which seeks to protect members of society from the risks of tobacco and its derivatives through the imposition of taxes on the production and importation of these products, thereby enhancing public health in the State of Qatar. It is worth noting that the tax stamp is a distinctive mark in the form of a physical label or a digital code containing encrypted data, affixed to excise-taxable goods. The General Tax Authority launched the first and second phases of the tax stamp system in 2022, while the third phase began implementation in early 2023 within local markets. This phase stipulates that all tobacco products and their derivatives circulated in local markets must bear approved tax stamps. The General Tax Authority affirmed that it will continue its inspection campaigns to monitor illicit trade in tobacco products, calling on all relevant entities to comply with the provisions of tax laws and related executive regulations to avoid legal accountability. The Authority also urged importers of cigarettes and other tobacco products to register on the “Dhareeba” platform under the excise goods track-and-trace system, noting that the import or circulation of any excise goods within the country is not permitted without valid and activated excise stamps. In this context, the Authority continues its efforts to promote a culture of voluntary compliance and strengthen public trust in the tax system, thereby contributing to higher levels of tax compliance.

The General Tax Authority (GTA) has announced that the tax return filing period for the financial year ended 31 December 2025, will commence on 1 January 2026 and continue until 30 April 2026. This comes in compliance with the provisions of Income Tax Law No. (24) of 2018, its Executive Regulations, and their amendments. The tax return filing requirements apply to all entities subject to the provisions of the Law, including tax-exempt companies, companies owned by Qatari nationals or nationals of the Gulf Cooperation Council (GCC) states, as well as private associations and institutions, private charitable associations and institutions, and private public-benefit institutions established in accordance with the laws governing each of them. The General Tax Authority urges all companies and institutions holding a commercial registration or trade license — including those exempt from tax — to submit their tax returns within the specified period through the electronic “Dhareeba” platform. The Authority also affirms its commitment to providing all forms of support and assistance to taxpayers and to facilitating the tax return filing process through its official communication channels, including the Call Center (16565) and email (support@dhareeba.qa), to ensure compliance with the prescribed legal deadlines. This approach comes as part of the Authority’s commitment to establishing a fair and transparent tax environment, implementing relevant laws and legislation, and enhancing the level of tax compliance.

The General Tax Authority organized a three-day chess training program in collaboration with the Qatar Chess Federation, with the participation of a number of male and female employees. This initiative reflects the Authority’s commitment to developing the intellectual and cognitive skills of its human capital. The program aims to enhance strategic thinking capabilities and develop planning and decision-making skills by introducing the fundamentals of chess and their practical applications. It focuses on analyzing situations, anticipating outcomes, and developing alternative strategies. This initiative comes as part of the General Tax Authority’s ongoing efforts to foster a positive and motivating work environment and to develop employees’ skills through innovative approaches that contribute to improving job performance and promoting a balance between professional development and intellectual activities, thereby positively impacting the quality of institutional performance.

.png)

The General Tax Authority (GTA) has announced the opening of the “Tabadol” portal for submitting Country-by-Country Reporting (CbCR) for the fiscal year 2024, as well as the notifications for the fiscal year 2025, with a deadline of December 31, 2025. This initiative targets taxpayers, accounting firms, and auditors, enabling the relevant authorities to gain a comprehensive and accurate view of the activities of multinational companies. The “Tabadol” portal is an electronic platform dedicated to exchange tax information with relevant authorities in partner jurisdictions, in line with international agreements. The GTA clarified that multinational companies headquartered in Qatar with total revenues of QAR 3 billion or more during the reported fiscal year are required to submit these reports and notifications. All targeted taxpayers are urged to comply with the deadlines and to use the portal to submit accurate information in a timely manner. The GTA emphasized that the purpose of these reports is to enhance trust and cooperation between countries in the field of taxation, improving law enforcement, and reducing the risk of double taxation, thereby contributing to a transparent and stable investment environment.

With the aim of strengthening economic and financial cooperation and encouraging joint investments, the State of Qatar and the Republic of Uruguay signed a bilateral agreement between their governments regarding the avoidance of double taxation on income and the prevention of tax evasion and avoidance. The agreement was signed by H.E. Ali bin Ahmed Al Kuwari, Minister of Finance of the State of Qatar, and H.E. Mario Lopetegui, Minister of Foreign Affairs of the Republic of Uruguay. The agreement seeks to avoid double taxation and remove obstacles that may hinder the movement of capital, thereby enhancing trade exchange and encouraging investment flows between the two countries. It also aims to establish a comprehensive legal framework that provides a fair tax environment, stimulates economic activities, facilitates investment flows, and strengthens opportunities for joint commercial cooperation, while emphasizing both parties’ commitment to applying the highest international standards of transparency through the exchange of verified financial information between the competent authorities of both countries. The agreement includes several technical provisions related to the regulation of income taxes across various sectors, most notably the international transport sector, as well as the taxation of associated enterprises, dividends, interest, and royalties. These measures are expected to create a favorable investment environment and encourage the flow of capital, contributing to economic stability and sustainable growth. The signing of this agreement reflects Qatar’s commitment to developing its financial and tax system and enhancing partnerships with friendly countries to support increased trade exchange and expand opportunities for joint investment.

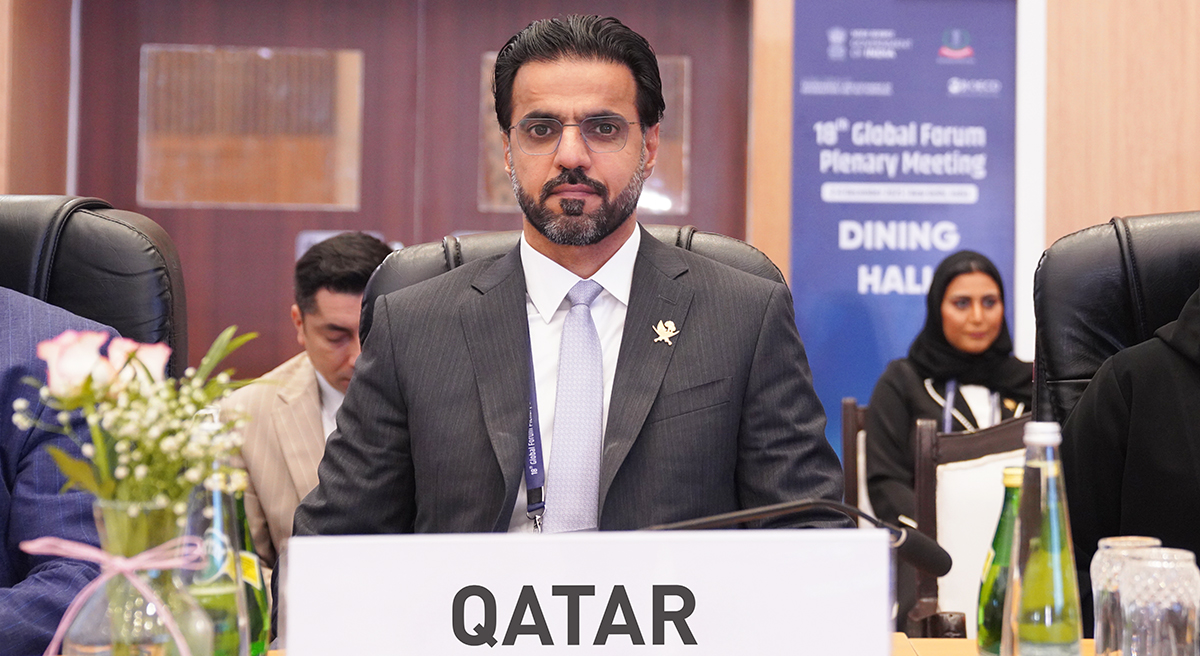

The State of Qatar participated with an official delegation headed by His Excellency Mr. Khalifa bin Jassim Al-Jaham Al-Kuwari, President of the General Tax Authority, in the 18th meeting of the Global Forum on Transparency and Exchange of Information for Tax Purposes. The meeting was held in New Delhi, Republic of India, with the participation of representatives from more than 170 countries and international organizations. During the meeting, the Qatari delegation reaffirmed Qatar's commitment to developing its legislative and regulatory framework to enhance tax compliance, particularly in the areas of Exchange of Information on Request (EOIR) and Automatic Exchange of Financial Information (AEOI). This is in addition to advancing the digital transformation of tax systems and developing tools for compliance and oversight. The delegation also participated in several discussion sessions and side events that addressed global progress in combating tax evasion, the role of transparency in improving tax collection efficiency, and increasing domestic revenues. Additionally, the events highlighted countries' experiences in implementing international standards and developing national capacities. Qatar's participation in this international event further underscores its active role in global forums on tax governance, its continuous efforts to promote the principles of tax transparency, and its commitment to developing information exchange mechanisms in line with international standards. Furthermore, it reflects Qatar's ongoing dedication to collaborating with international partners to enhance a fairer and more transparent global tax system.

Download Dhareeba app on your smart device now

Download Dhareeba app on your smart device now Call Center

Call Center Overseas

Overseas

Top of the Page

Top of the Page

Thank you for subscribing to the newsletter